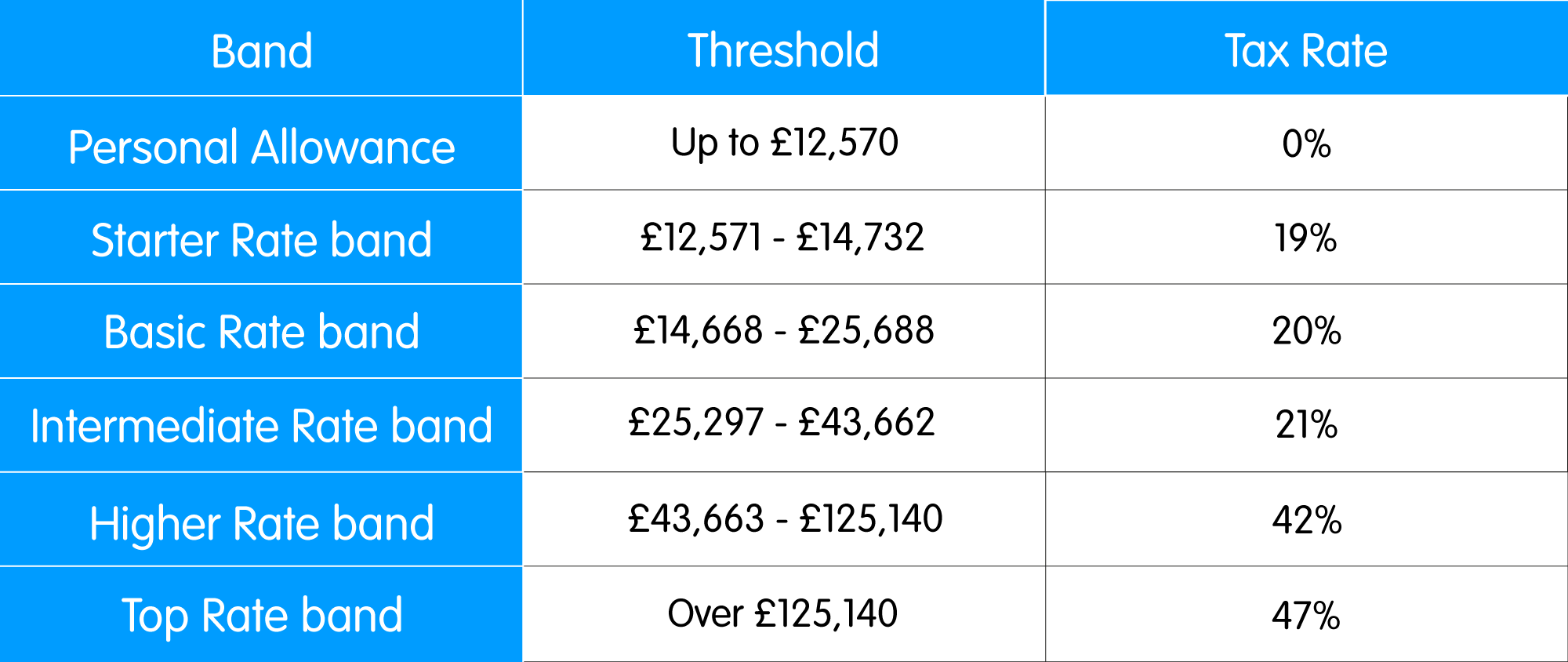

Income Tax Brackets Uk 2025

Income Tax Brackets Uk 2025. Scottish income tax bands are different. The 2025/25 income tax rates for britain are:

Tax allowances and exemptions are the amount you’re allowed to earn from income, savings, dividends and capital gains each tax year (6 april one year to 5 april the next). The basic rate of income tax remains at 20%, and this applies to earnings between £12,571 and £50,270.

Income Tax Brackets Uk 2025 Images References :

Source: marnaqopaline.pages.dev

Source: marnaqopaline.pages.dev

Uk Tax Brackets 2025/24 Caro Martha, We’ll look at the differences later.

Source: arlyneqmaritsa.pages.dev

Source: arlyneqmaritsa.pages.dev

2025 Tax Brackets Uk Kelli Ameline, The basic rate (20%), the higher.

Source: elysiakalinda.pages.dev

Source: elysiakalinda.pages.dev

High Tax Bracket 2025 Uk Jolyn Valentina, 0% tax on earnings up to £12,570;

Source: rutheqmelloney.pages.dev

Source: rutheqmelloney.pages.dev

2025 Tax Brackets Uk Dorine Katerina, 20% tax on earnings between £12,571 and.

Source: callycharlene.pages.dev

Source: callycharlene.pages.dev

Tax Rates 2025/24 Uk Calculator Roxi Jobyna, Your average tax rate is.

Source: doniellewabbi.pages.dev

Source: doniellewabbi.pages.dev

Tax Brackets 202425 Uk Ellyn Lisbeth, 20% tax on earnings between £12,571 and.

Source: idaqcharmion.pages.dev

Source: idaqcharmion.pages.dev

Tax Table 2025 Brena Clareta, Here’s a handy round up of the uk tax brackets and allowances for the current tax year (2025/25).

Source: fainaqrianon.pages.dev

Source: fainaqrianon.pages.dev

Effective Tax Bracket Calculator 2025 Edie Nikoletta, Basic rate band values for.

Source: imagetou.com

Source: imagetou.com

Tax Rates 2023 24 Uk Image to u, Looking for info on uk income tax rates?

Source: naraterrie.pages.dev

Source: naraterrie.pages.dev

Tax Brackets And Standard Deductions 2025 Alexi Lorain, 2023/2025 tax rates and allowances.